Funding and Debt Management

The NTMA Funding and Debt Management Unit is responsible for borrowing on behalf of the Government and managing the National Debt in order to ensure liquidity for the Exchequer and to minimise the interest burden over the medium term.

2025 Benchmark Bond Funding

€4bn completed from an annual bond funding range of €6bn to €10bn DownloadCash and Liquid Asset Balances

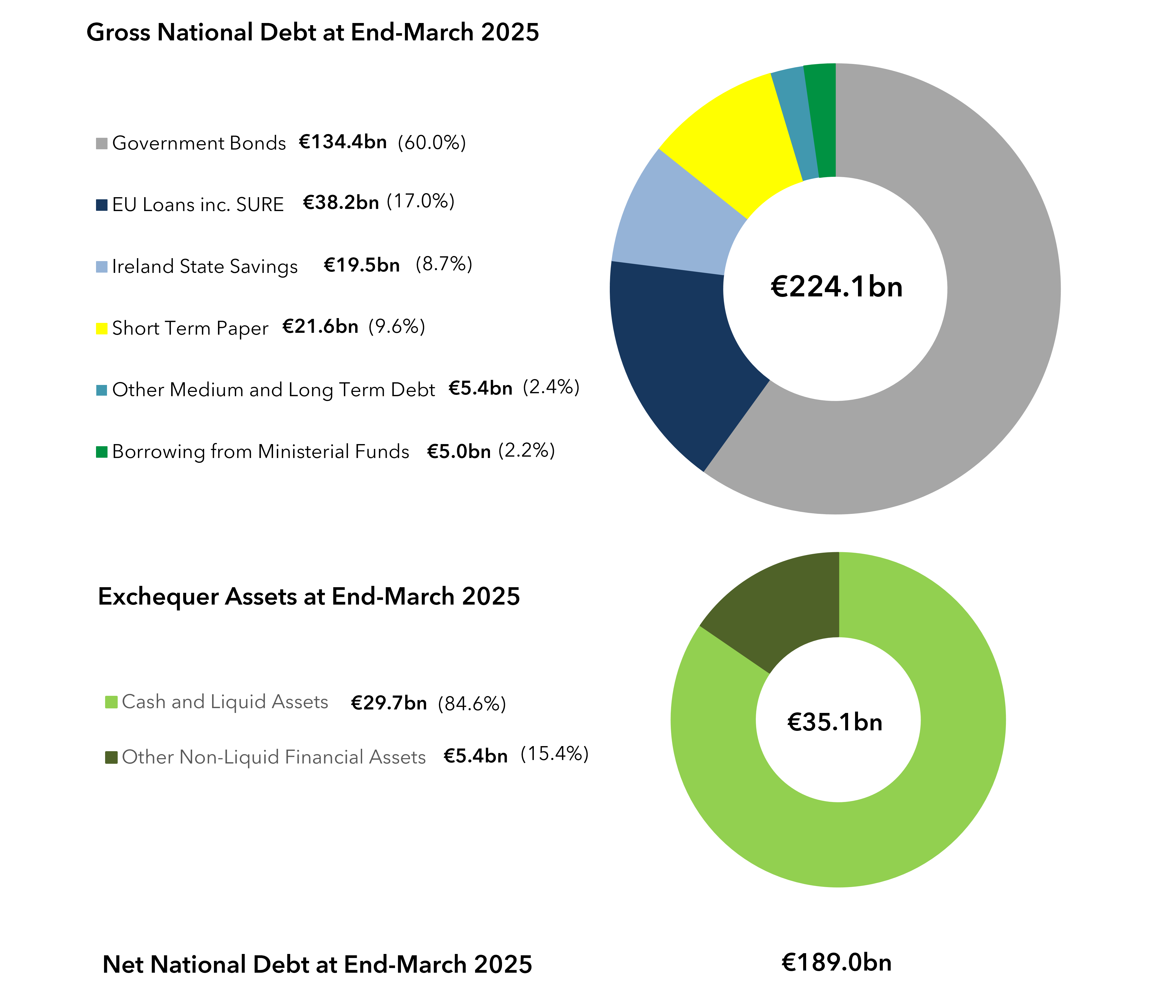

Exchequer cash and liquid asset balances of €29.7bn at end-March 2025 Read Moreslide 3 to 6 of 2

In this section of the website you will find information about Ireland’s debt profile and the NTMA’s short and long-term borrowing programmes. This section also contains information about the Irish economy and the public finances as well as some useful links to other official sources of information.